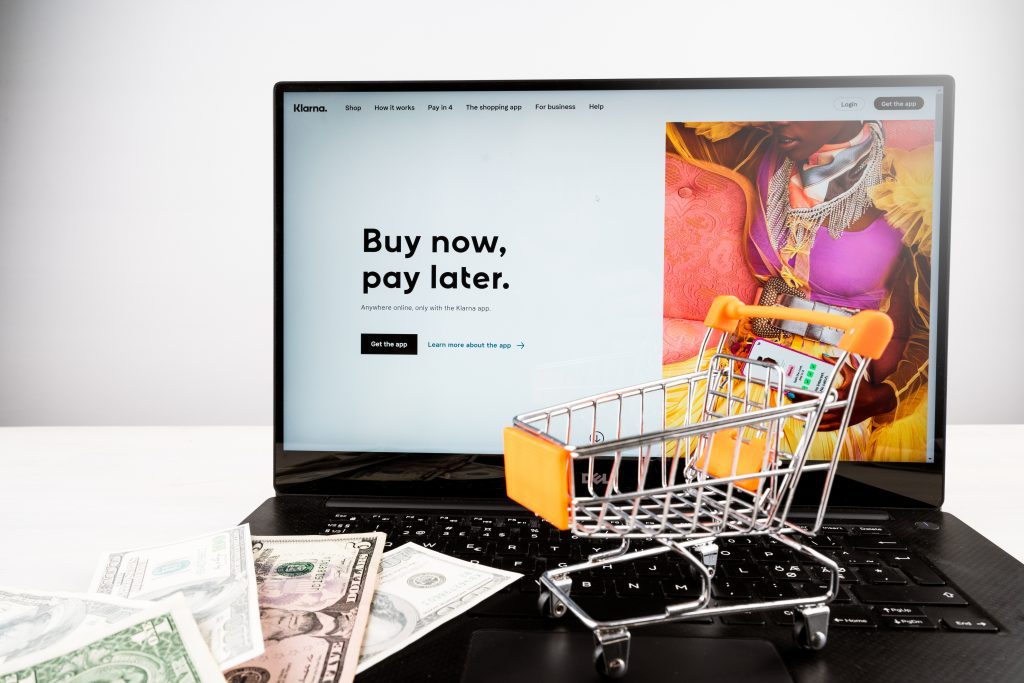

Paying for groceries has become such a struggle for some that consumers are searching for ways to offset the costs. While some shoppers are taking advantage of coupons or viral video hacks to slash their grocery bills, others are signing up for a program that defers in-full payment at the cash register. A number of major grocery retailers, including Albertsons, Costco and Target, now accept options for using “buy now, pay later” (BNPL) programs as an alternative to cash, debit, or credit card payments.

In the first two months of 2023, the usage of BNPL in the grocery sector jumped by 40%, according to a recent study released by Adobe Analytics.

“The rise of buy now, pay later usage for groceries tells us that consumers are likely making bigger purchases online to take advantage of special promotions and stock up on staples, thus managing living expenses in more flexible ways,” said Vivek Pandya, a lead analyst for Adobe.

How Does Buy Now, Pay Later Work?

Think of Buy Now, Pay Later as a loan you apply for and then have to pay back in installments.

For example, if a shopper has a $200 grocery bill, they would make a $50 down payment up front and pay the rest of the $150 balance over the next few weeks or months. For short-term loans, such as four weeks, many BNPL companies will not charge interest.

However, there are various fees for these loans, including service, transactional and rescheduling, and penalties for having insufficient funds and late payments. It’s vital to note that every BNPL company has different terms, so it’s important to review them carefully before applying for a loan.

Target Partners With Two BNPL Companies To Help Customers

How does it work as you’re shopping? Different retail chains are working with different BNPL services, so your experience can differ across retailers, but here’s one example: Target began working with two BNPL companies in 2021, Affirm and Sezzle.

To use Sezzle at Target, a customer must first go to the lender’s website and apply for a virtual card. Then, the shopper can shop via the Target app or website and select their new Sezzle card for payment. And, yes, it can be used for drive-up, pick-up and same-day delivery services provided by Shipt via Target.

Affirm works in a similar way, but purchases must be more than $100. Visit the Affirm website to download the app and then shop online at Target.com.

Buy Now, Pay Later Is Different Than A Credit Card

A buy now, pay later option might sound the same as using a credit card. However, there are some fundamental differences, according to Investopedia.

First, buy now, pay later options are available for consumers who might not have a credit card. These short-term loans are offered by companies such as PayPal, Afterpay, Affirm, Sezzle, and Zip and typically give a customer the option to choose an installment payback plan. Usually, it’s four payments over a couple of weeks or months. Typically, a down payment (25%) is made at the time of purchase and the rest of the balance is paid off in installments.

How Else Is BNPL Different Than Credit Cards?

The other major difference between buy now, pay later options and a credit card is the relative ease of securing a BNPL loan. The few restrictions for most customers who want to use PayPal Later, Affirm or other BNPL companies usually include that they must be at least 18 years old and have a debit card.

A credit score is not always necessary to secure a buy now, pay later loan, which means it can be easier for people with no established credit to take advantage of a payment plan. However, some BNPL companies will do what’s called a soft credit check to confirm a potential customer’s ability to repay the loan. A soft credit inquiry does not impact credit scores, nor does it stay on credit reports.

Are There Risks With Buy Now, Pay Later?

As with any form of credit or loan, there are risks involved with BNPL programs.

Financial experts at The Motley Fool warned that BNPL programs don’t offer the same protections as credit cards regarding billing errors, returns or other purchase issues. BNPL loans can also make it easier to overspend. And if you can’t make payments on time, you’ll want to be really careful with these programs.

BNPL loans can charge deferred interest — you might have a 0% loan for an introductory period, but if you are late paying it off, you’ll pay interest on your balance later.

There’s another big downside you should know about before you use a BNPL program: Your on-time payments aren’t reported to credit agencies, so you won’t get the same credit boost you get when you pay on other loans. But BNPL programs will report your late payments to credit agencies, so if you’re late, your credit takes a hit.

If you’re trying to watch your budget, be sure to review all buy now, pay later terms before signing up.

***Correction: Due to a reporting error, an earlier version of this story incorrectly listed Trader Joe’s as a retailer offering a BNPL program.

This story originally appeared on Don't Waste Your Money. Checkout Don't Waste Your Money for product reviews and other great ideas to save and make money.